SINGAPORE BUDGET 2016

Singapore’s Finance Minister Heng Swee Keat while delivering his first Budget speech in the Parliament on March 24, 2016, announced the following changes in Singapore’s tax regime:

Productivity and Innovation Credit (PIC) Scheme

The PIC scheme, ever since its introduction in 2011, has been instrumental in kick-starting the productivity drive in Singapore. After serving its purpose, the scheme will lapse after YA 2018 and will not be available from YA 2019. In addition, the cash payout rate will be lowered from 60% to 40% for qualifying Expenditure incurred on or after August 1, 2016.

In summary, under the Scheme, businesses will enjoy 400% tax deductions/ allowances for qualifying expenditure incurred in any of the six qualifying activities from YAs 2011 to 2018. Till now, eligible businesses could also exercise an irrevocable option to convert qualifying expenditure of up to $100,000 for each YA into cash, at a conversion rate of 60%. This rate has been lowered to 40% for qualifying expenditure incurred from August 1, 2016.

More details will be released by the IRAS in May 2016 to facilitate businesses’ transition to the cash payout rate of 40%.

This change is indicative of the Government’s focus on more targeted and sectoral-focused initiatives under the newly-launched Industry Transformation Programme.

As an additional measure, the Finance Minister also introduced mandatory e-Filing of PIC cash payout applications, which will be effective from August 1, 2016.

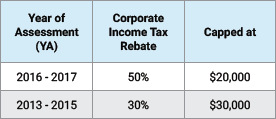

Corporate Income Tax Rebate

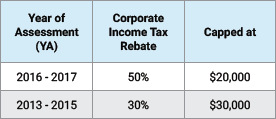

To help companies, especially the SMEs restructure in the midst of the current economic climate, the Corporate Income Tax rebate will be raised to 50% for YA 2016 and YA 2017, subject to a cap of $20,000 rebate per YA. This is up from the 30% announced in Budget 2015.

So in summary, the rebates to be given are:

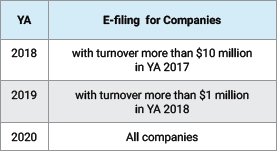

E-filing of Corporate Income Tax

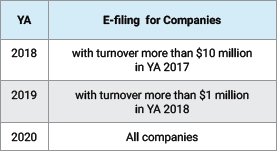

As Singapore marches on to become a Smart Nation and harness technology to enhance productivity, e-filing of corporate income tax returns (including ECI, Form C and Form C-S) will be made mandatory in a phased approach from YAs 2018 to 2020.

Automation Support Package

The Finance Minister in a bid to support firms to automate, drive productivity and scale up, also announced that qualifying projects may be eligible for an Investment Allowance (IA) of 100% on the amount of approved capital expenditure under the Automation Support Package. This will be in addition to the existing capital allowance for plant and machinery. Although, it must be noted that the approved capital expenditure is capped at $10 million per project.

The Ministry of Trade and Industry will announce more details of the Automation Support Package at the Committee of Supply.

Mergers & Acquisitions (M&A) Scheme

Although IRAS will release further details by June 2016, the Finance Minister announced some changes that will apply to qualifying M&A deals made from April 1, 2016, to March 31, 2020, which included doubling the existing cap for qualifying M&A deals from $20 million to $40 million, such that:

• tax allowance of 25% for up to $40 million of consideration paid for qualifying M&A deals per YA; and

• stamp duty relief for up to $40 million of consideration paid for qualifying M&A deals per financial year

Business and IPC Partnership Scheme (BIPS)

The Government aiming to encourage employee volunteerism through businesses has introduced a new scheme - Business and IPC Partnership Scheme.

Currently, expenditure incurred by businesses for corporate social responsibility activities is deductible as revenue expenditure if the conditions in Section 14(1) of the Income Tax Act are satisfied. But now, under BIPS, for services provided from July 1, 2016, to December 31, 2018, businesses will enjoy a further 150% tax deduction on these qualifying expenditure incurred when they send their employees to volunteer and provide services to Institutions of Public Character (IPCs), including secondments.

Section 13Z of the Income Tax Act (ITA)

Under Section 13Z applicable to companies’ disposal of equity investments from June 1, 2012, to May 31, 2017, gains derived from the disposal of equity investments by companies is not taxed, if:

a) the divesting company holds a minimum shareholding of 20% in the company whose shares are being disposed; and

b) the divesting company maintains the minimum 20% shareholding for a minimum period of 24 months just prior to the disposal.

In other scenarios, the tax treatment of the gains/ losses arising from share disposals is determined per case basis.

Now, in order to provide upfront certainty to companies in their corporate restructuring, the scheme will be extended till May 31, 2022, to cover disposal of equity investments from June 1, 2017, to May 31, 2022.

Double Tax Deduction (DTD)

While IE Singapore will release details of the change by June 2016, the FM announced extension of the DTD for Internationalisation scheme for another four years from April 1, 2016, to March 31, 2020. Additionally, the existing automatic DTD on expenses up to $100,000 will also be extended to qualifying expenditure incurred during this same period.

Land Intensification Allowance Scheme

The Land Intensification Allowance (LIA) announced in 2010 - available to businesses in industry sectors with large land takes and low Gross Plot Ratios (GPR) – has been enhanced to encourage co-location of activities and allow a more efficient value supply chain. While the Economic Development Board will release details by July 2016, the summary of changes are -

The “minimum floor area” requirement has been enhanced - for LIA applications submitted to EDB from March 25, 2016, with the application for planning permission or conservation permission made from March 25, 2016 - as follows:

• allow building used by a single user to undertake multiple prescribed trades or businesses to qualify; and

• allow building used by multiple users who are related and undertaking one or multiple prescribed trades or businesses to qualify.

With the above enhancements, a building or structure can qualify for the LIA if at least 80% of the total floor area of the building or structure is used by one or more users who are related to undertake one or multiple prescribed trades or businesses.

Intellectual Property Rights (IPRs) Under Section 19B of the ITA

For qualifying IPR acquisitions made within the basis periods between YA 2017 and YA 2020, companies may elect for their Section 19B WDA to be claimed over a writing-down period of 5, 10, or 15 years. This irrevocable election must be made at the point of submitting the tax return of the YA relating to the basis period in which the qualifying cost is first incurred. Further details will be released by the IRAS by April 30, 2016.

Also, to ensure that Section 19B writing down allowances are granted based on transacted values that are reflective of the open market value (OMV) of an IPR, an anti-avoidance mechanism for IPR transfers will be included under Section 19B.

The FTC is being extended till March 31, 2021, with the concessionary tax rate to be lowered to 8%, though the substantive requirements to qualify for the scheme will be increased. Moreover, the scope of tax exemption granted under Section 13(4) will also be expanded to cover interest payments on deposits placed with the FTC by its non-resident approved offices and associated companies.

Tax Incentive Scheme for Trustee Companies

From April 1, 2016, the Tax Incentive Scheme for Trustee Companies will be subsumed under the Financial Sector Incentive (FSI) scheme. While the Monetary Authority of Singapore will release further details by June 2016, the Finance Minister announced expansion of the qualifying activities to align with trustee activities covered under the Financial Sector Incentive-Standard Tier (“FSI-ST”) scheme from April 1, 2016, for new and current incentive recipients.

Furthermore, a concessionary tax rate of 12% will apply to new awards from April 1, 2016.

The FM also announced that the tax incentive schemes for Marine Hull and Liability Insurance, Specialised Insurance Business and Captive Insurance will be subsumed under the Insurance Business Development (IBD) umbrella scheme. This measure is aimed at streamlining and simplying the tax incentives for the insurance sector.

For the Marine Hull and Liability Insurance scheme, a concessionary tax rate of 10% will apply to new and renewal awards from April 1, 2016. For the Specialised Insurance Business scheme, a concessionary tax rate of 8% will apply to new awards from September 1, 2019. For the Captive Insurance scheme, a concessionary tax rate of 10% will apply to new and renewal awards from April 1, 2018.

The Finance Minister also announced enhancement in the MSI effective March 25, 2016, to further develop Singapore as an international maritime centre.

Shipping enterprises operating Singapore-registered and foreign ships enjoy tax exemptions on certain types of shipping income under Section 13A of the Income Tax Act (ITA). Also, approved international shipping enterprises operating ships plying in international waters enjoy tax exemptions on certain types of international shipping income under Section 13F of the ITA.

Notably, an approved international shipping enterprise is one approved under the “Maritime Sector Incentive - Approved International Shipping Enterprise award (MSI-AIS)” that is administered by the Maritime and Port Authority of Singapore (MPA).

The enhancement announced by the FM on the Budget Day meant that now approved international shipping enterprises can also enjoy tax exemption on income (derived on or after Mar 25, 2016) from:

• exploration or exploitation of offshore energy

• exploration or exploitation of offshore mineral extraction

• ancillary activities supporting the offshore activities in the above two activities

To make the personal income tax regime more progressive, the total amount of personal income tax reliefs that an individual can claim will be capped at $80,000 per year of assessment from 2018. The Government will release more details by June 2016.

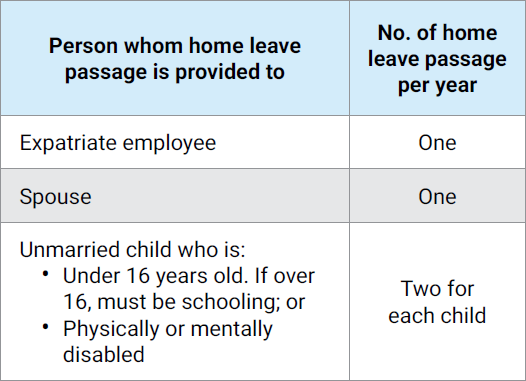

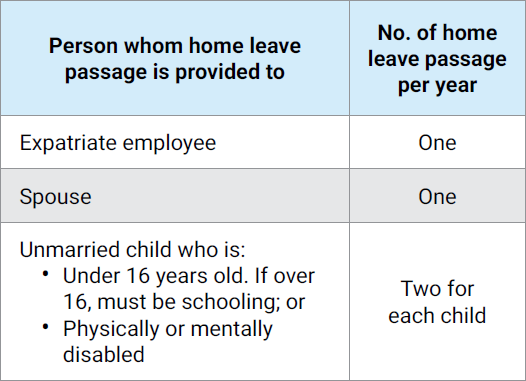

Home leave passage

The tax concession of taxing only 20% of the value of home leave passages for expatriate employees will be removed with effect from year of assessment 2018.

This policy was in place to encourage foreigners to relocate to Singapore. Under this, some tax rebate was given on relocation benefits such as cash allowances and reimbursements, and home leave passages. Especially for Home Leave Passgaes, as a tax concession, only 20% of the cost of the leave passage was taxed. This concession was limited to:

With this new announcement though, the home leave passages provided to expatriate employees, their spouses and children are taxable in full from YA 2018.

From April 1, 2016, all employers in Singapore are required to issue itemised pay slips and key employment terms (KETs) to employees covered under the Employment Act (EA). Additionally, a new framework is also in place to treat less severe breaches of the EA. According to the Ministry of Manpower (MOM), these changes are in place to improve employment standards; as well as facilitate the resolution of any employment-related disputes.

This is a win-win for everybody as – while employees will have a better understanding of how their salaries are calculated, their employment terms and benefits; employers, on the other hand, will have to deal with lesser disputes at the workplaces.

Moreover while announcing these changes in August 2015, MOM assured employers of a light-touch and educating approach. Employers also have the option of taping into an assistance package which includes funding, one-to-one assistance for SMEs, software for generating itemised pay slips, and providing blank payslips and KETs templates that can be filled in by hand.

These changes come after an intensive feedback collection exercise conducted by the Government through several platforms, including public consultations conducted in July to October 2013. Later, proposals were evaluated by employers, unions and the Government, and fine-tuned. The details of the changes are as follows:

Itemised Pay Slips

All employees covered under the Employment Act must issue itemised pay slips, which must be given together with the payment or within three working days of payment. This may be in soft or hard copy (including handwritten). In the case of termination or dismissal, employer must give pay slips together with the outstanding salary. Additionally, employers must keep a record of all pay slips issued.

Employment Records

Along with the records of pay slips, employers in Singapore are now required to maintain records for all employees covered by the Employment Act in soft or hard copy (including handwritten). These records – employee records and salary records (same as itemised pay slips) - must be maintained:

• latest two years for current employees

• for ex-employees - last two years, to be kept for one year after the employee leaves employment

Key Employment Terms (KETs)

Employers must issue KETs in writing (soft or hard copy including handwritten) to all employees who enter into a contract of service on or after April 1, 2016, are covered by the Employment Act, and are employed for 14 days or more. Please note that this refers to the length of contract, not the number of days of work. The common KETs to be included (if applicable) are leave policy, medical benefits, working arrangements, salary period, basic salary, fixed allowances, fixed deductions, probation period, notice period etc. Notably, these KETs can also be provided through the employee handbook or company intranet.

Some civil breaches that can attract administrative penalties under the amended Employment Act of Singapore are:

• Itemised Pay Slips – failure to issue, or issuing inaccurate or incomplete

• Employment Records – not maintaining detailed records

• Key Employment Terms (KETs) – failure to issue in writing, or issuing inaccurate or incomplete

But MOM assured the employers that it will “will adopt a light-touch enforcement approach and focus on educating employers in the first year”.

Employment Act Assistance Package for Employers

Finally, to help employers cope with the changes in place since April 1, 2016, the MOM has announced an assistance package.

This includes a guidebook published in all the four national languages – English, Tamil, Malay and Mandarin – on how to comply with KETs and itemised pay slips. This is available at MOM Services Centre, National Trades Union Congress, Singapore National Employers Federation, Singapore Business Federation, Association of Small and Medium Enterprises, Tripartite Alliance for Fair and Progressive Employment Practices and SME Centres.

Ongoing seminars and workshops are also being organised by the Singapore National Employers Federation, Singapore Business Federation, Tripartite Alliance for Fair and Progressive Employment Practices, and Ong Teng Cheong Labour Leadership Institute.

Advisory Services for SMEs

Additionally, SMEs can approach the business advisers at any of the SME Centres for one-to-one assistance on the EA, including the guidance on relevant Government assistance schemes.

SMEs are also being encouraged to use tools such as SP-Pay pay slip software developed by students from Singapore Polytechnic’s (SP) Diploma in Business Information Technology.

Moreover, businesses with complex needs can apply for funding to adopt IT solutions for the new Employment Act requirements. One of the most popular schemes in this regard is the Productivity and Innovation Credit (PIC). “Businesses that send their HR officers for Employment Act-related training, or acquire or upgrade their IT systems to issue pay slips, etc., can tap on the PIC scheme,” informs the MOM.

FOR COMPANIES ENTITES

Productivity and Innovation Credit (PIC) Scheme

The PIC scheme, ever since its introduction in 2011, has been instrumental in kick-starting the productivity drive in Singapore. After serving its purpose, the scheme will lapse after YA 2018 and will not be available from YA 2019. In addition, the cash payout rate will be lowered from 60% to 40% for qualifying Expenditure incurred on or after August 1, 2016.

In summary, under the Scheme, businesses will enjoy 400% tax deductions/ allowances for qualifying expenditure incurred in any of the six qualifying activities from YAs 2011 to 2018. Till now, eligible businesses could also exercise an irrevocable option to convert qualifying expenditure of up to $100,000 for each YA into cash, at a conversion rate of 60%. This rate has been lowered to 40% for qualifying expenditure incurred from August 1, 2016.

More details will be released by the IRAS in May 2016 to facilitate businesses’ transition to the cash payout rate of 40%.

This change is indicative of the Government’s focus on more targeted and sectoral-focused initiatives under the newly-launched Industry Transformation Programme.

As an additional measure, the Finance Minister also introduced mandatory e-Filing of PIC cash payout applications, which will be effective from August 1, 2016.

Corporate Income Tax Rebate

To help companies, especially the SMEs restructure in the midst of the current economic climate, the Corporate Income Tax rebate will be raised to 50% for YA 2016 and YA 2017, subject to a cap of $20,000 rebate per YA. This is up from the 30% announced in Budget 2015.

So in summary, the rebates to be given are:

E-filing of Corporate Income Tax

As Singapore marches on to become a Smart Nation and harness technology to enhance productivity, e-filing of corporate income tax returns (including ECI, Form C and Form C-S) will be made mandatory in a phased approach from YAs 2018 to 2020.

Automation Support Package

The Finance Minister in a bid to support firms to automate, drive productivity and scale up, also announced that qualifying projects may be eligible for an Investment Allowance (IA) of 100% on the amount of approved capital expenditure under the Automation Support Package. This will be in addition to the existing capital allowance for plant and machinery. Although, it must be noted that the approved capital expenditure is capped at $10 million per project.

The Ministry of Trade and Industry will announce more details of the Automation Support Package at the Committee of Supply.

Mergers & Acquisitions (M&A) Scheme

Although IRAS will release further details by June 2016, the Finance Minister announced some changes that will apply to qualifying M&A deals made from April 1, 2016, to March 31, 2020, which included doubling the existing cap for qualifying M&A deals from $20 million to $40 million, such that:

• tax allowance of 25% for up to $40 million of consideration paid for qualifying M&A deals per YA; and

• stamp duty relief for up to $40 million of consideration paid for qualifying M&A deals per financial year

Business and IPC Partnership Scheme (BIPS)

The Government aiming to encourage employee volunteerism through businesses has introduced a new scheme - Business and IPC Partnership Scheme.

Currently, expenditure incurred by businesses for corporate social responsibility activities is deductible as revenue expenditure if the conditions in Section 14(1) of the Income Tax Act are satisfied. But now, under BIPS, for services provided from July 1, 2016, to December 31, 2018, businesses will enjoy a further 150% tax deduction on these qualifying expenditure incurred when they send their employees to volunteer and provide services to Institutions of Public Character (IPCs), including secondments.

Section 13Z of the Income Tax Act (ITA)

Under Section 13Z applicable to companies’ disposal of equity investments from June 1, 2012, to May 31, 2017, gains derived from the disposal of equity investments by companies is not taxed, if:

a) the divesting company holds a minimum shareholding of 20% in the company whose shares are being disposed; and

b) the divesting company maintains the minimum 20% shareholding for a minimum period of 24 months just prior to the disposal.

In other scenarios, the tax treatment of the gains/ losses arising from share disposals is determined per case basis.

Now, in order to provide upfront certainty to companies in their corporate restructuring, the scheme will be extended till May 31, 2022, to cover disposal of equity investments from June 1, 2017, to May 31, 2022.

Double Tax Deduction (DTD)

While IE Singapore will release details of the change by June 2016, the FM announced extension of the DTD for Internationalisation scheme for another four years from April 1, 2016, to March 31, 2020. Additionally, the existing automatic DTD on expenses up to $100,000 will also be extended to qualifying expenditure incurred during this same period.

Land Intensification Allowance Scheme

The Land Intensification Allowance (LIA) announced in 2010 - available to businesses in industry sectors with large land takes and low Gross Plot Ratios (GPR) – has been enhanced to encourage co-location of activities and allow a more efficient value supply chain. While the Economic Development Board will release details by July 2016, the summary of changes are -

The “minimum floor area” requirement has been enhanced - for LIA applications submitted to EDB from March 25, 2016, with the application for planning permission or conservation permission made from March 25, 2016 - as follows:

• allow building used by a single user to undertake multiple prescribed trades or businesses to qualify; and

• allow building used by multiple users who are related and undertaking one or multiple prescribed trades or businesses to qualify.

With the above enhancements, a building or structure can qualify for the LIA if at least 80% of the total floor area of the building or structure is used by one or more users who are related to undertake one or multiple prescribed trades or businesses.

Intellectual Property Rights (IPRs) Under Section 19B of the ITA

For qualifying IPR acquisitions made within the basis periods between YA 2017 and YA 2020, companies may elect for their Section 19B WDA to be claimed over a writing-down period of 5, 10, or 15 years. This irrevocable election must be made at the point of submitting the tax return of the YA relating to the basis period in which the qualifying cost is first incurred. Further details will be released by the IRAS by April 30, 2016.

Also, to ensure that Section 19B writing down allowances are granted based on transacted values that are reflective of the open market value (OMV) of an IPR, an anti-avoidance mechanism for IPR transfers will be included under Section 19B.

FOR FINANCE COMPANIES

Finance and Treasury Centre (FTC) SchemeThe FTC is being extended till March 31, 2021, with the concessionary tax rate to be lowered to 8%, though the substantive requirements to qualify for the scheme will be increased. Moreover, the scope of tax exemption granted under Section 13(4) will also be expanded to cover interest payments on deposits placed with the FTC by its non-resident approved offices and associated companies.

Tax Incentive Scheme for Trustee Companies

From April 1, 2016, the Tax Incentive Scheme for Trustee Companies will be subsumed under the Financial Sector Incentive (FSI) scheme. While the Monetary Authority of Singapore will release further details by June 2016, the Finance Minister announced expansion of the qualifying activities to align with trustee activities covered under the Financial Sector Incentive-Standard Tier (“FSI-ST”) scheme from April 1, 2016, for new and current incentive recipients.

Furthermore, a concessionary tax rate of 12% will apply to new awards from April 1, 2016.

FOR INSURANCE COMPANIES

Tax Incentive Schemes for Insurance CompaniesThe FM also announced that the tax incentive schemes for Marine Hull and Liability Insurance, Specialised Insurance Business and Captive Insurance will be subsumed under the Insurance Business Development (IBD) umbrella scheme. This measure is aimed at streamlining and simplying the tax incentives for the insurance sector.

For the Marine Hull and Liability Insurance scheme, a concessionary tax rate of 10% will apply to new and renewal awards from April 1, 2016. For the Specialised Insurance Business scheme, a concessionary tax rate of 8% will apply to new awards from September 1, 2019. For the Captive Insurance scheme, a concessionary tax rate of 10% will apply to new and renewal awards from April 1, 2018.

FOR MARITIME COMPANIES

Maritime Sector Incentive (MSI)The Finance Minister also announced enhancement in the MSI effective March 25, 2016, to further develop Singapore as an international maritime centre.

Shipping enterprises operating Singapore-registered and foreign ships enjoy tax exemptions on certain types of shipping income under Section 13A of the Income Tax Act (ITA). Also, approved international shipping enterprises operating ships plying in international waters enjoy tax exemptions on certain types of international shipping income under Section 13F of the ITA.

Notably, an approved international shipping enterprise is one approved under the “Maritime Sector Incentive - Approved International Shipping Enterprise award (MSI-AIS)” that is administered by the Maritime and Port Authority of Singapore (MPA).

The enhancement announced by the FM on the Budget Day meant that now approved international shipping enterprises can also enjoy tax exemption on income (derived on or after Mar 25, 2016) from:

• exploration or exploitation of offshore energy

• exploration or exploitation of offshore mineral extraction

• ancillary activities supporting the offshore activities in the above two activities

FOR INDIVIDUALS

Personal income taxTo make the personal income tax regime more progressive, the total amount of personal income tax reliefs that an individual can claim will be capped at $80,000 per year of assessment from 2018. The Government will release more details by June 2016.

Home leave passage

The tax concession of taxing only 20% of the value of home leave passages for expatriate employees will be removed with effect from year of assessment 2018.

This policy was in place to encourage foreigners to relocate to Singapore. Under this, some tax rebate was given on relocation benefits such as cash allowances and reimbursements, and home leave passages. Especially for Home Leave Passgaes, as a tax concession, only 20% of the cost of the leave passage was taxed. This concession was limited to:

With this new announcement though, the home leave passages provided to expatriate employees, their spouses and children are taxable in full from YA 2018.

From April 1, 2016, all employers in Singapore are required to issue itemised pay slips and key employment terms (KETs) to employees covered under the Employment Act (EA). Additionally, a new framework is also in place to treat less severe breaches of the EA. According to the Ministry of Manpower (MOM), these changes are in place to improve employment standards; as well as facilitate the resolution of any employment-related disputes.

This is a win-win for everybody as – while employees will have a better understanding of how their salaries are calculated, their employment terms and benefits; employers, on the other hand, will have to deal with lesser disputes at the workplaces.

Moreover while announcing these changes in August 2015, MOM assured employers of a light-touch and educating approach. Employers also have the option of taping into an assistance package which includes funding, one-to-one assistance for SMEs, software for generating itemised pay slips, and providing blank payslips and KETs templates that can be filled in by hand.

These changes come after an intensive feedback collection exercise conducted by the Government through several platforms, including public consultations conducted in July to October 2013. Later, proposals were evaluated by employers, unions and the Government, and fine-tuned. The details of the changes are as follows:

Itemised Pay Slips

All employees covered under the Employment Act must issue itemised pay slips, which must be given together with the payment or within three working days of payment. This may be in soft or hard copy (including handwritten). In the case of termination or dismissal, employer must give pay slips together with the outstanding salary. Additionally, employers must keep a record of all pay slips issued.

Employment Records

Along with the records of pay slips, employers in Singapore are now required to maintain records for all employees covered by the Employment Act in soft or hard copy (including handwritten). These records – employee records and salary records (same as itemised pay slips) - must be maintained:

• latest two years for current employees

• for ex-employees - last two years, to be kept for one year after the employee leaves employment

Key Employment Terms (KETs)

Employers must issue KETs in writing (soft or hard copy including handwritten) to all employees who enter into a contract of service on or after April 1, 2016, are covered by the Employment Act, and are employed for 14 days or more. Please note that this refers to the length of contract, not the number of days of work. The common KETs to be included (if applicable) are leave policy, medical benefits, working arrangements, salary period, basic salary, fixed allowances, fixed deductions, probation period, notice period etc. Notably, these KETs can also be provided through the employee handbook or company intranet.

Some civil breaches that can attract administrative penalties under the amended Employment Act of Singapore are:

• Itemised Pay Slips – failure to issue, or issuing inaccurate or incomplete

• Employment Records – not maintaining detailed records

• Key Employment Terms (KETs) – failure to issue in writing, or issuing inaccurate or incomplete

But MOM assured the employers that it will “will adopt a light-touch enforcement approach and focus on educating employers in the first year”.

Employment Act Assistance Package for Employers

Finally, to help employers cope with the changes in place since April 1, 2016, the MOM has announced an assistance package.

This includes a guidebook published in all the four national languages – English, Tamil, Malay and Mandarin – on how to comply with KETs and itemised pay slips. This is available at MOM Services Centre, National Trades Union Congress, Singapore National Employers Federation, Singapore Business Federation, Association of Small and Medium Enterprises, Tripartite Alliance for Fair and Progressive Employment Practices and SME Centres.

Ongoing seminars and workshops are also being organised by the Singapore National Employers Federation, Singapore Business Federation, Tripartite Alliance for Fair and Progressive Employment Practices, and Ong Teng Cheong Labour Leadership Institute.

Advisory Services for SMEs

Additionally, SMEs can approach the business advisers at any of the SME Centres for one-to-one assistance on the EA, including the guidance on relevant Government assistance schemes.

SMEs are also being encouraged to use tools such as SP-Pay pay slip software developed by students from Singapore Polytechnic’s (SP) Diploma in Business Information Technology.

Moreover, businesses with complex needs can apply for funding to adopt IT solutions for the new Employment Act requirements. One of the most popular schemes in this regard is the Productivity and Innovation Credit (PIC). “Businesses that send their HR officers for Employment Act-related training, or acquire or upgrade their IT systems to issue pay slips, etc., can tap on the PIC scheme,” informs the MOM.